Dear Protribers,

So today, we will be talking about the “Making of Money”. Did you know that earning forms one of the components of Personal Finance? I mean, let’s really look at it; what is Personal Finance without the ability to really earn? It is from earning whether direct, passive or residual that all other aspects of Personal Finance flows -budgeting (managing money), investing (multiplying money) and protection of assets (estate planning). So, you see how important this subject matter is and the truth is we must learn the right way to go about earning money.

If you are living in Nigeria, then we are all aware how difficult it is for a vast majority to actually make ends meet. It is without saying that sometimes, we do not earn enough to take care of our bills from our primary jobs or even as entrepreneurs, we do not pay ourselves. So, what happens? Don’t forget that we had mentioned in our previous article (https://www.prosharefoundation.com/knowledge/blog/belief-systems-and-how-it-affects-your-personal-finance) about how your Belief System can make or mar your abilities to earn. Having the ability to command the kind of earnings you want requires first – skills and competence; there are other factors that contribute also to this however, let us quickly examine the types of income we have.

Streams of Income

1) Earned Income- this is income earned from doing – this is income one earns from a job; it may come as a salary, wages, commissions or bonuses. Earned income is usually subject to tax which vary due to tax laws.

2) Business Income – This is income derived from a side hustle one sets up. Business income may be from just one source or multiple sources. This type of income is also subject to some form of tax; however, this is dependent on the turnover as defined by the law especially in Nigeria where there is a new policy that speaks to the taxing of SMEs.

3) Interest Income – this is income that one receives from making a deposit in a finance house -bank. To know about more what you have earned from saving with your bank you may want to check your bank statement. Interest income may also come in the form of interest on a loan you have given which is often found in peer-to peer lending.

4) Capital Gains – this is income acquired from the sale of assets such as Art, shares, business or loans. This income is subject to Capital gains tax deductible from a lump sum rather than consistently over time.

5) Royalties or Licensing Income – This is income a lot of creative people enjoy. Creatives such as photography, music, poetry and much more. Licensing these for public usage means one can generate income via royalties.

6) Gifts – This is any form of income that comes to you in the form of cash either as a direct deposit to your bank account or physical cash. It is often seen in how we gift people monies during festive seasons or on memorable occasions.

7) Rental Income – this is income that one can get from renting out one’s property. In Nigeria, rental income is generated annually but with the advent of Airbnb’s it is possible to generate weekly or monthly income from this stream. Since properties are subject to tax in the form of land use charge- tax, it stands to reason that income generated from such property should factor this expense.

Now, let us go further in this discourse. As we begin to get enlightened on how we go about making money, let us be mindful that all of these income types are categorized as either Active, Residual or Passive incomes. For anyone to truly build sustainable wealth; it is almost impossible to achieve this through ‘’Earned income” alone.

What is Passive Income?

This is money earned from an enterprise with little or no ongoing effort involved but most likely the prior investment to achieve a passive income stream does take time and money. Passive income can be earned in various ways such as renting out your property, dividend from shares, royalty, selling an asset or craft, investment, online e-commerce store, digital book, peer-to-peer lending.

Passive income while setting up may be risky but it offers an unprecedented amount of financial security, provides steady cash flow and can provide much needed security because it does not necessarily require you to invest your time and quit your regular 8-6 job.

What is Active Income?

This is money earned in the form of salaries, wages, tips or commissions. An active income means that one is performing tasks related to one’s job or career and getting paid for the value and time being brought to achieve this. For active income; time is the real currency and it is a guaranteed source of income except your employer has financial strain in a downturn economy or revenue generating challenges that will make paying salaries difficult.

What is Residual Income?

This is income that is similar to Passive Income however it is income that is available after financial obligations have been met. In the Personal Finance journey, one needs to have a blue print of one’s financial goals; it can never be a haphazard decision because goals can either be short, mid or long term and a true picture of realistic goals positions one to make financial decisions that will directly impact on the overall financial goal. Now, this article is not saying the only pathway to making money is having these streams. The truth is some will have and others will have more. The goal should be to never be reliant on only one stream of income and to find ways to diversify where our money comes from in the present. Doing this allows us to become balanced in our Personal finance as we are not daunted if one stream becomes volatile or even crashes; the available others are there to tide us and help make our abilities to create more wealth readily available.

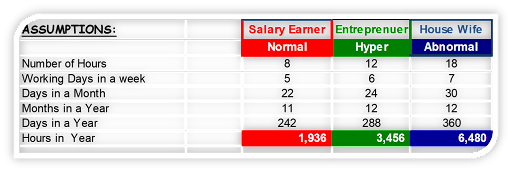

One of the primary things we need to do for ourselves is to know ‘the value of our time: how much is an hour worth to us” or “How much are we worth per hour”. This knowledge does not just give us as individuals the ability to maximize our productivity but may also allow us to be able to project to meet our financial goals.

Here is a quick way to calculate what you are worth, track your time and how you can make a conscious decision to increase your earning capacities. –

Time worth = Total amount earned / No. of hours spent working

Where amount earned = income from salary + side hustles and freelance activities

In our subsequent articles, we will touch more on the value of time and money. Don’t forget you can read our past articles and learn more about what we do by clicking here (insert link to website/blogpost).

With love and wellness,

PFDN team.